are corporate campaign contributions tax deductible

And the same goes. To put it another way financial.

Are Political Contributions Tax Deductible Smartasset

Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income.

. However the irs does not allow contributions to any. In a nutshell the quick answer to the question Are political contributions deductible is no. 50 of the next 350.

Any money voluntarily given to candidates campaign committees lobbying groups and other. If youre wondering if campaign contributions are tax deductible for your business the same rules apply. After making a contribution donors often ask whether they can deduct contributions to a candidate or political cause of.

As circularized in Revenue Memorandum Circular 38-2018 and as reiterated in RMC 31-2019 campaign contributions are not included in the taxable income of the candidate. The answer is no as Uncle Sam specifies that funds contributed to the political campaign cannot be deducted from taxes. In most states you cant deduct political contributions but four states do allow a tax break for political campaign contributions or donations made to political candidates.

Many believe this rumor to be true but contrary to popular belief the answer is no. Here are other examples of items that Uncle Sam stipulates that one. Individuals can contribute up to 2800 per election to the campaign committee up to 5000 per year for pac and up to 10000 per year for local or district.

You cannot claim political deductions on your tax return for your. According to the Internal Service Review IRS The IRS Publication 529states. Costs to facilitate a tax-free corporate distribution under IRC Section 355 such as a spin-off split-off or split-up must be capitalized and are not currently deductible.

All four states have rules and limitations around the tax break. Herein Are your political campaign contributions tax deductible. The giving of campaign contributions is recognized under batas pambansa 881.

Contributions to civic leagues or other section 501c4 organizations generally are not deductible as charitable contributions for federal income tax purposes. A corporation may deduct qualified contributions of up to 25 percent. On the part of the.

Donations utilized before or after the campaign period are subject to donors tax and not deductible as political contributions on the part of the donor. So if you happen to be one of the many people donating to political candidates campaign funds dont expect to deduct any of those contributions on your next tax return. The irs states you cannot deduct contributions made to a political candidate a campaign.

Deduction Under Section 80ggb And 80ggc Of Income Tax Act Corpbiz

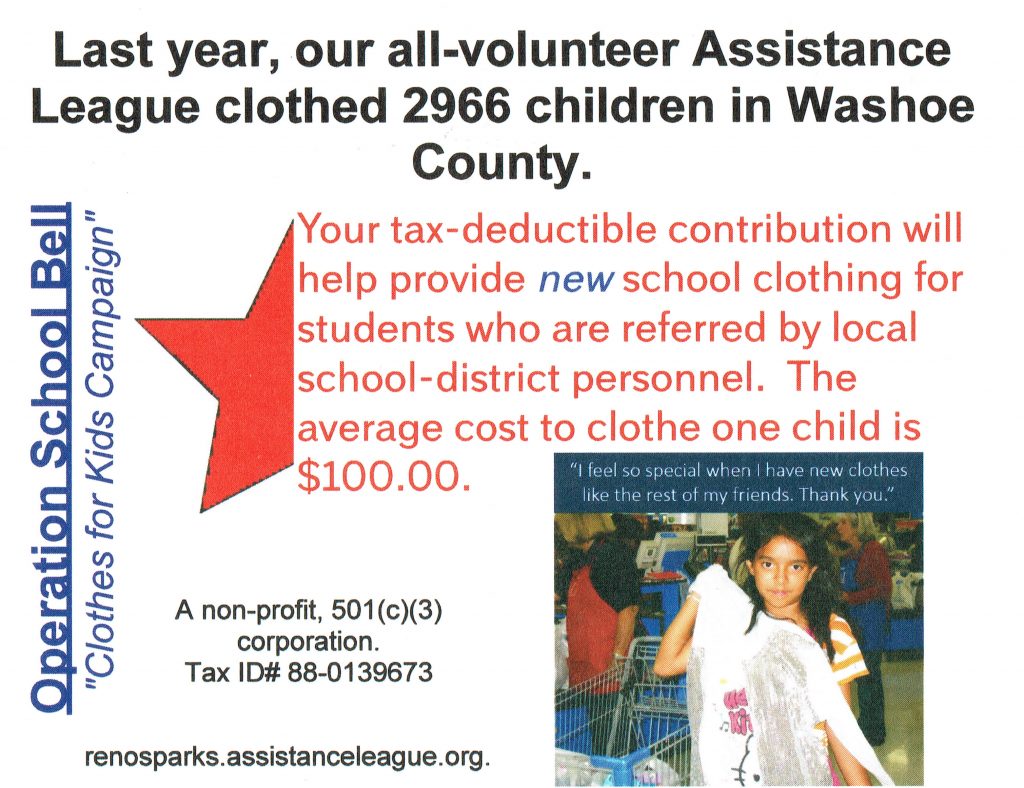

Charitable Contributions Archives Picnic

Are Your Political Contributions Tax Deductible Taxact Blog

Are Political Contributions Tax Deductible Personal Capital

Are Political Contributions Tax Deductible Anedot

Everything You Need To Know About Your Tax Deductible Donation Learn Globalgiving

Are Political Contributions Or Donations Tax Deductible The Turbotax Blog

Clothes For Kids Campaign Assistance League Of Reno Sparksassistance League Of Reno Sparks

Deduction Under Section 80ggb 80ggc For Donations Made To Political Parties Or Electoral Trust How To Earn Money Through Small Savings

How Did The Tcja Affect Incentives For Charitable Giving Tax Policy Center

Campaign Finance In The United States Wikipedia

Campaign Finance In The United States Wikipedia

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

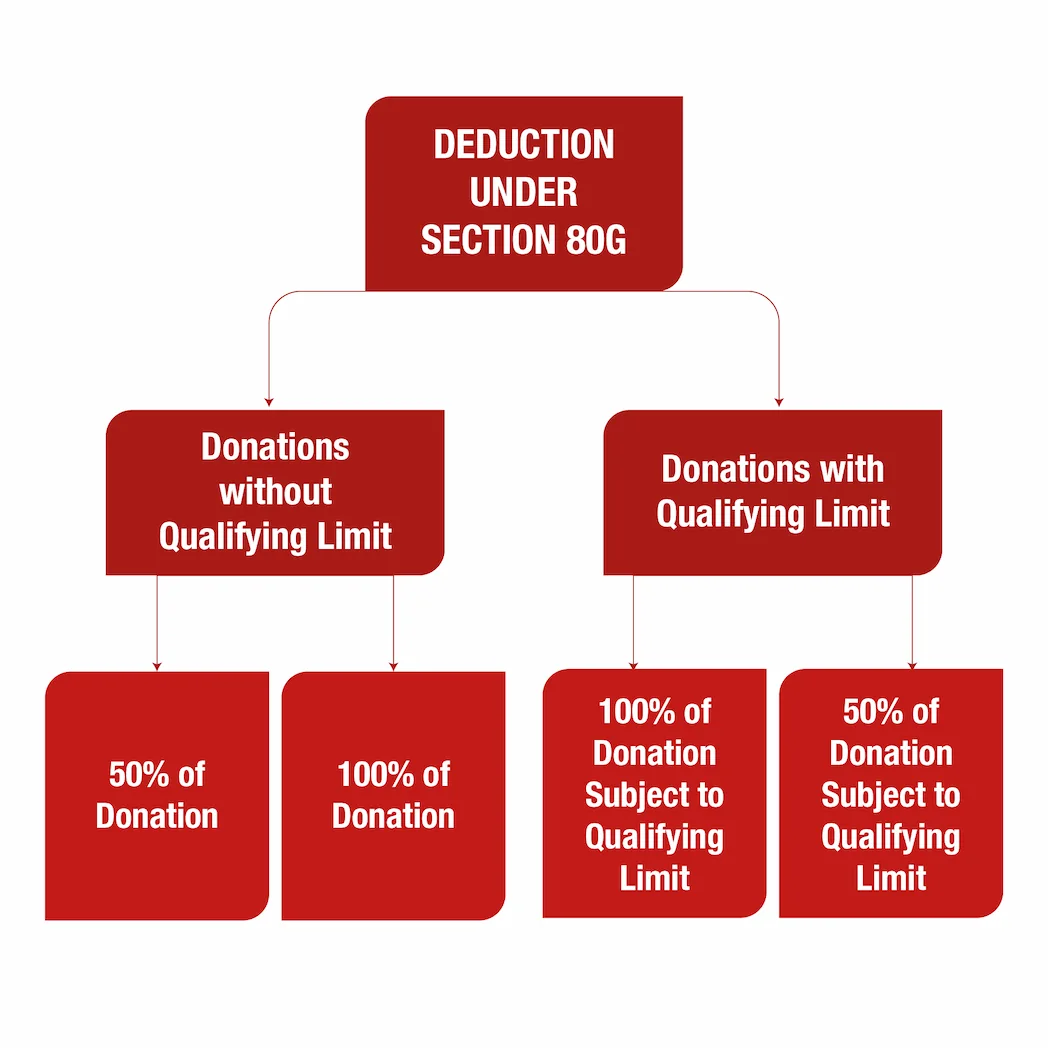

Section 80g Deduction Tax Benefits On Donation Made To Ngo

Lao Political Action Committee

Traci Koster On Twitter With November S Campaign Fast Approaching I Hope You And Your Family Can Join Us For Our Campaign Kickoff On Tuesday April 12th At Sacred Pepper From 5 30